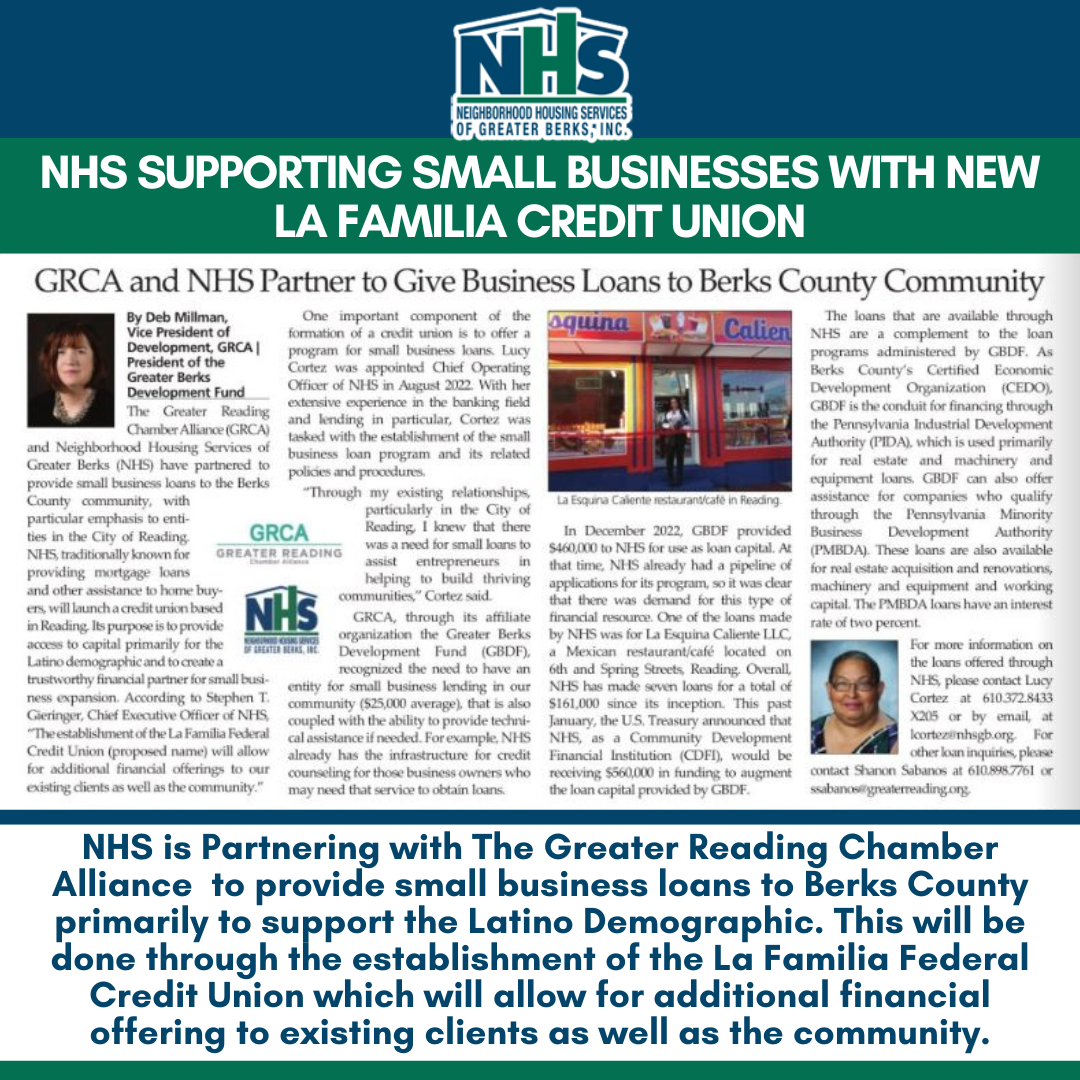

NHS is Partnering with The Greater Reading Chamber Alliance to provide small business loans to Berks County primarily to support the Latino Demographic. This will be done through the establishment of the La Familia Federal Credit Union which will allow for additional financial offering to existing clients as well as the community.

!

Thank you very much to everyone who came out last Friday to the @fightins game! On Thursday, June 8th we’re going to be celebrating NHS Night at the stadium! On that night, we are proud to be sponsoring the fireworks show! We look forward to seeing everyone on June 8!

FY 2022 CDFI Program Award Book

NHSGB is incredibly grateful to have been selected by the U.S. Department of the Treasury’s Community Development Financial Institutions Fund (CDFI Fund) to receive an award of $560,000! We were among 252 Community Development Financial Institutions (CDFIs) to receive $194.1 million in Financial Assistance (FA) awards. This generous contribution will help us to substantially increase our lending and investment activities in disadvantaged and distressed neighborhoods and communities.

“This investment from the Fund allows for NHSGB to continue its intentional work of creating new homeowners in affordable housing across all of PA,” said Stephen T. Gieringer, CEO. “With this injection of equity, NHSGB’s lending capacity is enhanced — providing greater access to affordable housing outcomes, creating jobs, and empowering underserved communities throughout Pennsylvania.”

U.S. Treasury Awards in Excess of $194 Million to Spur CDFI Investment in Distressed and Underserved Areas across the Nation

Washington, DC – The U.S. Department of the Treasury’s Community Development Financial Institutions Fund (CDFI Fund) awarded 252 Community Development Financial Institutions (CDFIs) $194.1 million in Financial Assistance (FA) awards today. The awards, through the fiscal year (FY) 2022 round of the Community Development Financial Institutions Program (CDFI Program) and the Native American CDFI Assistance Program (NACA Program), will enable CDFIs to substantively expand lending and investment activity in disadvantaged and distressed neighborhoods and communities.

“I am pleased to announce the fiscal year 2022 CDFI Program and NACA Program Financial Assistance Award Recipients,” said CDFI Fund Director Jodie Harris. “Financial Assistance Awards provide CDFIs with capital critical for establishing new businesses, creating jobs, financing affordable housing and increasing homeownership, and providing financial services in low-income and distressed communities nationwide.” “The question of who can access credit and capital – and who can’t – is at the root of many long-term structural problems in our economy,” said Assistant Secretary for Financial Institutions Graham Steele. “By channeling more capital into CDFIs, we are reaching places and communities that the financial sector historically hasn’t served well – and by doing so, we are helping to create an economy that works for everyone.”

The FY 2022 CDFI Program and NACA Program Financial Assistance Award Recipients include 137 loan funds; 73 credit unions; 40 depository institutions and holding companies, and two venture capital funds. Award recipients also included 23 CDFIs that are also Minority Depository Institutions, as designated by the Federal Deposit Insurance Corporation and National Credit Union Administration.

Collectively, FA awards encompass Base Financial Assistance (Base-FA) and the following awards that are provided as a supplement to a Base-FA award: Healthy Food Financing Initiative-Financial Assistance (HFFI-FA), Persistent Poverty Counties-Financial Assistance (PPC-FA), and Disability Funds-Financial Assistance (DF-FA).

CDFI Program Financial Assistance Awards

The CDFI Program invests in and builds the capacity of CDFIs to serve low-income people and underserved communities lacking adequate access to affordable financial products and services. For the FY 2022 CDFI Program round, the CDFI Fund awarded $127.1 million in Base-FA awards to 233 organizations in 41 states, the District of Columbia, and Puerto Rico. The CDFI Fund also awarded $17.6 million in PPC-FA awards to 137 CDFIs specifically to serve Persistent Poverty Counties nationwide.

In addition, the CDFI Fund awarded $23 million in HFFI-FA awards to eight CDFIs. The Healthy Food Financing Initiative is a supplemental program designed to encourage investments in businesses that provide healthy food options for communities. The CDFI Fund also awarded $6.5 million in DF-FA awards to 13 CDFIs; DF-FA is a supplemental program designed to help CDFIs finance projects and services to assist individuals with disabilities.

NACA Program Financial Assistance Awards

The NACA Program helps Native CDFIs increase access to credit, capital, and financial services in Native Communities. Organizations funded through the NACA Program serve a wide range of Native American, Alaska Native, and Native Hawaiian communities. The CDFI Fund awarded $17.1 million in FY 2022 NACA Program Base-FA awards to 19 organizations in 13 states. In addition, 10 Native CDFIs received $2.8 million in PPC-FA awards.

The CDFI Fund also provides Technical Assistance awards to CDFIs and emerging CDFIs through the CDFI Program and NACA Program. The FY 2022 Technical Assistance Awards were announced on September 26, 2022.

View more information about all of the FY 2022 CDFI Program and NACA Program awards below.

FY 2022 CDFI Program and NACA Program Award Resources

FY 2022 CDFI Program Award Book

FY 2022 NACA Program Award Book

CDFI Program and NACA Program Financial Assistance Application Evaluation Process

CDFI Program and NACA Program Technical Assistance Application Evaluation Process

*Please note, the CDFI Fund expects to open a combined FYs 2023 and 2024 CDFI Program and NACA Program application round in fall 2023. Prior to this, the CDFI Fund will solicit public feedback on the FA and TA applications, as well as the evaluation process. A Request for Comment will be published in the Federal Register in the coming days.

About the CDFI Fund

Since its creation in 1994, the CDFI Fund has awarded nearly $5.7 billion to CDFIs, community development organizations, and financial institutions through: the Bank Enterprise Award Program; the Capital Magnet Fund; the CDFI Rapid Response Program; the Community Development Financial Institutions Program, including the Healthy Food Financing Initiative; the Economic Mobility Corps; the Financial Education and Counseling Pilot Program; and the Native American CDFI Assistance Program. In addition, the CDFI Fund has allocated $71 billion in tax credit allocation authority to Community Development Entities through the New Markets Tax Credit Program, and closed guaranteed bonds for more than $2.1 billion through the CDFI Bond Guarantee Program.

To learn more about the CDFI Fund and its programs, please visit the CDFI Fund’s website at www.cdfifund.gov

Reasonable Accommodations: Requests for reasonable accommodations under section 504 of the Rehabilitation Act should be directed to Jay Santiago at the CDFI Fund at 202-653-0300.